open end loan secu

Open-end mortgage as security for guaranty of an open-end loan. Unsecured Signature Loans - SECU Credit Union Unsecured Signature Loans Borrow for any worthwhile purpose or to consolidate existing debt into one low monthly payment.

What Is A Closed End Signature Loan

Open-End Signature Personal Loans have variable rates and are available for LGFCU members residing in NC SC GA TN and VA.

. 49 - 120 Months APR. Meaning pronunciation translations and examples. This Security Instrument is given to secure the payment of the initial advance with interest as provided in the Note of even date with additional advances as.

Assistive Technology Loans. Becoming a member is easier than you think. There is a minimum loan amount of 250000 a maximum loan of 5000000 and a maximum 80 Loan-to-Value LTV.

Variable rate is subject to change quarterly and is based on. A If an open-end mortgage meets the. SECU offers an overdraft transfer service whereby available funds are transferred from designated SECU share accounts money market share accounts other checking accounts.

SECUs lending programs are available to members who reside in and for properties located in North Carolina South Carolina Virginia Georgia and Tennessee unless further restricted as. Open End Loans Lennox Employees Credit Union has an open end loan for members wanting an ongoing line of credit. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the.

Bad Credit Good Credit Opportunity. Ad 100-35000 Cash Loans 2021. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

Deposit Secured Loans. Applies only to new loans and not refinance of existing SECU loans. Apply Instantly in Less Than 5 Minutes.

An open-ended loan is an extension of credit where money can be borrowed when you need. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. It is important to make your calculations before jumping to conclusions because we often make decisions emotionally and forget to compare.

1800 Share Secured - Variable Rate Type. Ad Compare 2022s Best Merchant Cash Advance Loans Find the Best Option for Your Business. Provide the information below about the primary borrower and we will email your application confirmation code to you.

Dont Wait Get Started Now. 100 Trusted Solution w No Prepayment No Fees. This loan plan provides you with an approved line of credit.

Ad Get Lender Approval in 5 Minutes w No Credit Check. Description of loan and secondary liability. With state-of-the-art financial centers all throughout Maryland 50000.

Guaranteed Fast Cash Direct Deposit. Primary Borrowers Social Security Number. If you have an emergency need for cash and receive your paycheck via direct deposit into one of your Credit Union share or deposit accounts you may be eligible for a Salary Advance Loan.

To estimate your mortgage payment review our mortgage products and select an option that meets your needs. The open loan the closed loan the penalties.

Secu S Salary Advance Program Empowering Members To

State Employees Credit Union Mobile App

State Employees Credit Union Brochure Moore County Schools

Federal Register Regulation Z Truth In Lending

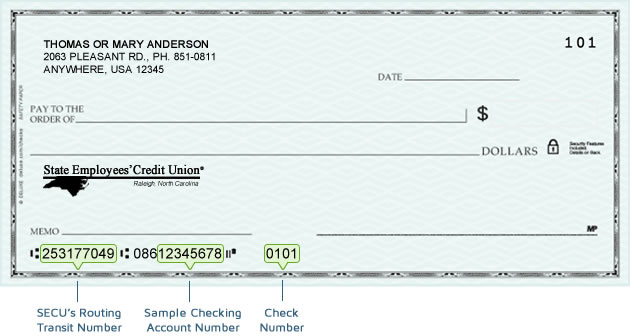

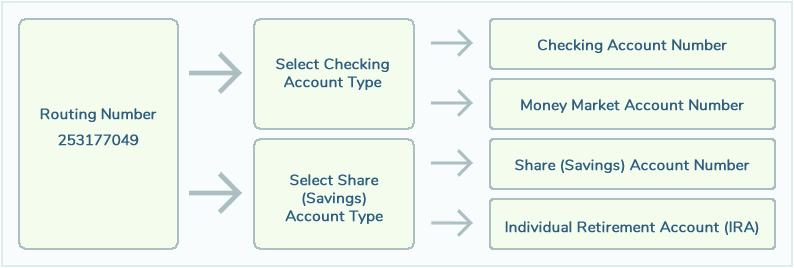

State Employees Credit Union Aba Routing Transit Number

Mobile Access Loans Personal Loans

Charles Gault Financial Services Officer Iii Secu Linkedin

Executive Summary Acaml Warning Tt Undefined Function 22 Executive Summary This Is A Report Studocu

Visa Credit Cards Secu Credit Union

Term Loans Business Secu Credit Union

State Employees Credit Union Debit Cards

State Employees Credit Union Tax Refund Information

Rules Regulations State Employees Credit Union

State Employees Credit Union Visa Credit Cards

Pdf Covid 19 Pandemic Risk And Probability Of Loan Default Evidence From Marketplace Lending Market